This article will walk you through the process of how to conduct market research to maximize your company’s product development success. In today’s marketplace, where everything seems to be moving in a snap of a finger, and the whole society has become a dog-eat-dog world, launching a successful product requires more than just a great idea and a solid design. No, this is no longer enough, now more than ever.

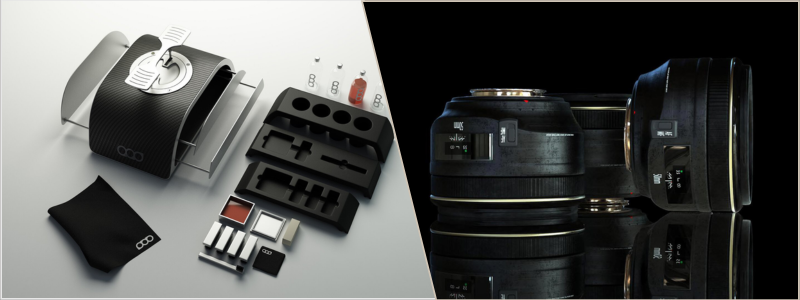

Cad Crowd is the industry’s top agency for product design services, with over 94,000 experts you can choose from to help you turn your idea into a tangible one. Whether you’re looking for innovative solutions, strategic insights, or top-tier execution, CAD Crowd has the expertise and the talent to bring your vision to life.

Understanding your target market and their needs is crucial to the success of your product development process. Market research provides this vital insight as it lets you to make informed decisions, minimize risks, and maximize the chances of your product’s success.

🚀 Table of contents

- Understanding the importance of market research in product development

- Types of market research

- Defining your research objectives

- Identifying and segmenting your target market

- Gathering and analyzing data

- Applying market research to product development

- Continuous market research

- In Summary

- How Cad Crowd can help

Understanding the importance of market research in product development

Market research serves as the foundation for any successful product development initiative. It provides data-driven insights that help companies understand their target market. First is understanding your customer needs and preferences; the design of the product must meet specific market needs, especially if you will analyze the behavior, preferences, and pain points of your target customers. Knowing the market trends helps you stay updated on industry trends as it ensures that your product remains relevant and competitive.

A competitive landscape makes you understand your competitors’ strengths and weaknesses, which allows you to differentiate your product and identify potential market gaps. Risk mitigation is important in market research in identifying potential risks and challenges early for product development experts, allowing for proactive strategies to address them. Without market research, companies risk developing products that do not resonate with their target audience, leading to wasted resources and missed opportunities.

RELATED: How to integrate CAD seamlessly into your firm’s workflow of engineering, design & services

Types of market research

There are several types of market research that you can conduct to gather relevant data for product design services that will surely help your business.

| Primary research: This type of research is highly specific to your product and provides firsthand insights as it involves collecting data directly from your target audience. | Focus groups: Small groups of customers discuss their opinions about your product concept, providing valuable feedback on potential improvements. Interviews: One-on-one interviews provide in-depth qualitative insights into customer attitudes, motivations, and pain points. Observations: Observing customers in their natural environment can reveal unspoken needs and behaviors that surveys or interviews might not capture. Surveys and questionnaires: These are useful for gathering quantitative data on customer preferences, needs, and behaviors. They can be conducted online, via email, or in person. |

| Secondary research: This type of research is cost-effective and provides a broader understanding of market trends and competitive analysis, which involves analyzing existing data collected by other sources. | Academic journals: These offer in-depth analysis and research studies on specific industries or consumer behaviors. Competitor analysis: Analyzing competitors’ products, marketing strategies, and customer reviews helps you understand their strengths and weaknesses. Government publications: Data from government sources, such as census data or economic reports, can provide valuable demographic and economic insights. Industry reports: These provide insights into market trends, growth projections, and key players in the industry. |

| Qualitative vs. quantitative research | It’s important to balance qualitative and quantitative research methods. While qualitative research (e.g., interviews, focus groups) provides deeper insights into customer motivations and emotions, quantitative research (e.g., surveys, data analysis) offers measurable data that can guide decision-making. |

Defining your research objectives

Before diving into market research, it’s crucial to define clear objectives. Typically, this process may be effective when companies start to consider them during the concept design service. What do you hope to achieve with your research? Common objectives include:

- Assessing market demand: This involves gauging the size and growth potential of your target market.

- Identifying customer needs: You have to understand the specific needs and pain points of your target audience.

- Pricing strategies: It is important to settle for the optimal pricing strategy based on customer willingness to pay and competitor pricing.

- Understanding competitive dynamics: You need to identify your key competitors and understand their strategies.

- Validating product concepts: It is imperative to test the viability and appeal of your product ideas before moving into development.

Clear objectives will guide your research process, ensuring that you gather the right data to inform your product development decisions.

RELATED: Validating new product design ideas: 5 questions every CAD and 3D modeling firm should ask

Identifying and segmenting your target market

One of the most critical aspects of market research is identifying your target market and segmenting it based on specific criteria. This process involves:

Identifying your target audience

Start by defining your ideal customer profile. Knowing your target audience will help you design specific functions for your product. You can consider the following factors for your consumer product firm below:

- Demographics: Demographics cover the age, gender, income level, education, occupation, and the like.

- Geographics: Location, climate, and population density are covered by geography.

- Psychographics: When you talk of psychographics, these include lifestyle, values, interests, and attitudes.

- Behavioral: Purchase behavior, brand loyalty, and product usage make up the behavioral factor.

Understanding these characteristics helps you tailor your product to meet the specific needs of your target audience.

Market segmentation

Market segmentation involves dividing your target audience into smaller, more manageable groups based on shared characteristics. Common segmentation strategies include:

- Demographic segmentation: Grouping customers based on demographic factors such as age, gender, and income.

- Geographic segmentation: Segmenting the market based on geographic factors, such as region, climate, or urban vs. rural.

- Psychographic segmentation: Grouping customers based on their lifestyle, values, and personality traits.

- Behavioral segmentation: Segmenting the market based on customer behaviors, such as purchase frequency or brand loyalty.

Segmenting your market allows you to create more targeted and effective marketing strategies, ensuring that your product resonates with each group.

Gathering and analyzing data

Once you’ve defined your research objectives and identified your target market, it’s time to gather and analyze data. This process involves:

Data collection

Analyzing the data you’ve collected is crucial to extracting actionable insights. Use statistical tools and software to analyze quantitative data and look for patterns and themes in qualitative data. Industrial design experts use common data analysis techniques that include:

- SWOT analysis: SWOT analysis assesses your product’s strengths, weaknesses, opportunities, and threats.

- Gap analysis: Gap analysis identifies the gaps in the market that your product can fill.

- Trend analysis: Trend analysis focuses on analyzing the market trends to predict future developments.

- Competitive analysis: Comparative analysis is about comparing your product with competitors to identify areas for differentiation.

The goal of data analysis is to translate raw data into meaningful insights that can guide your product development strategy.

Applying market research to product development

With your data analyzed, the next step is to apply these insights to your product development process. Here’s how:

- Product concept development: Use your research findings to refine your product concept. This might involve making adjustments to the product’s features, design, or functionality to better align with customer needs and preferences.

- Prototype testing: Before launching a full-scale product, consider developing a prototype or minimum viable product (MVP). Use prototype design engineering services to gather feedback from a select group of customers, allowing you to make further refinements before mass production.

- Pricing strategy: Your research should inform your pricing strategy. Consider factors such as customer willingness to pay, competitor pricing, and production costs when determining the optimal price point for your product.

- Marketing and positioning: Market research should also guide your marketing and positioning strategies. Use your insights to craft messaging that resonates with your target audience, highlights your product’s unique selling points (USPs), and differentiates it from competitors.

Continuous market research

Market research is not a one-time activity; it should be an ongoing process throughout the product lifecycle. Continuously gathering customer feedback and monitoring market trends ensures that your product remains relevant and competitive in the long term.

- Post-launch feedback: After launching your product, continue to gather customer feedback through surveys, reviews, and social media monitoring. Use this feedback to identify areas for improvement and to make data-driven decisions about product updates or enhancements.

- Competitor monitoring: Keep a close eye on your competitors to stay informed about new products, pricing changes, and marketing strategies. This allows you to adjust your own strategies to maintain a competitive edge.

- Market trend analysis: Regularly analyze market trends to identify emerging opportunities or threats. This will help you stay ahead of the curve and adapt your product development strategy as needed.

In Summary

Conducting thorough market research is essential to maximizing your company’s product development success. By understanding your target audience, identifying market trends, and analyzing competitors, you can make informed decisions that increase the likelihood of your product’s success.

Whether you’re developing a new product or refining an existing one, market research provides the insights needed to create products that resonate with your audience and stand out in the marketplace.

RELATED: Essential product design checklist when working with freelance experts & services companies

How Cad Crowd can help

If you’re ready to take your product development to the next level, Cad Crowd is here to help. Our team of experts can assist you in finding the best professionals who can do the legwork for you, from market research to product design and development. Request a quote today, and let us help you bring your vision to life.